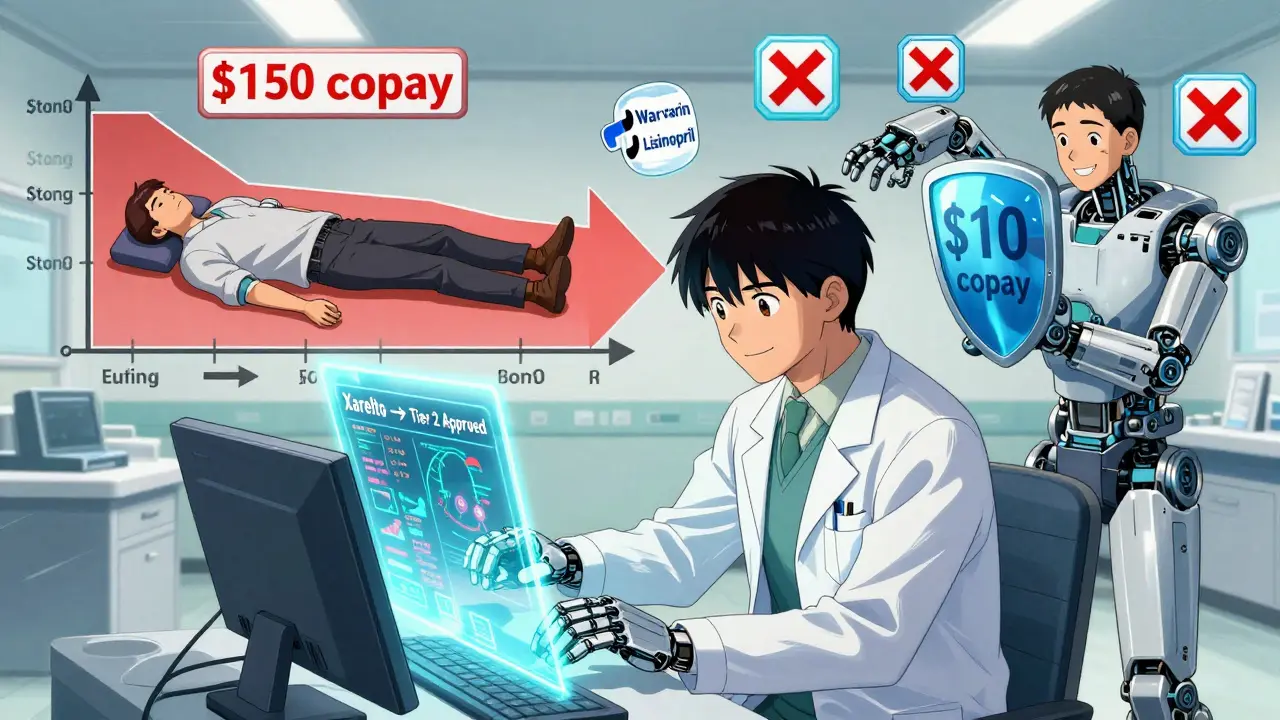

When you pick up your prescription and see the copay is $150 instead of the $20 you expected, it’s not a mistake - it’s likely because your drug is on a higher tier. Many Medicare Part D plans use a tiered system to control costs, putting medications into different price levels. But here’s the thing: tier exceptions can cut those costs dramatically - sometimes to zero. And most people don’t even know they exist.

What Exactly Is a Tier Exception?

A tier exception is a formal request to your Medicare drug plan to move a medication from a higher-cost tier to a lower one. It’s not about getting a drug that’s not on the formulary. It’s about getting the drug you’re already prescribed - but at a cheaper price. For example, if your drug is on Tier 4 (where you pay $100 or more per month), a successful tier exception could move it to Tier 1, where you pay $0 or $10. That’s not a small difference. It’s $1,200 a year saved on one prescription. According to the Medicare Rights Center, beneficiaries who successfully use tier exceptions save an average of $37.50 per fill. For someone on multiple medications, that adds up fast. The system was created in 2006 under Medicare Part D. The idea was simple: encourage patients to use lower-cost drugs by making them cheaper. But it didn’t account for everyone’s medical needs. That’s where tier exceptions come in. They’re the safety valve - letting patients get the right drug, not just the cheapest one.How Drug Tiers Work (And Why You’re Paying More)

Most Medicare Part D plans have 4 or 5 tiers. Here’s what they usually look like:- Tier 1: Generic drugs - $0 to $15 copay

- Tier 2: Preferred brand-name drugs - $10 to $40 copay

- Tier 3: Non-preferred brand-name drugs - $50 to $100 copay

- Tier 4: Preferred specialty drugs - 20% to 30% coinsurance (often $100-$300/month)

- Tier 5: Non-preferred specialty drugs - 30% to 40% coinsurance ($500-$1,500/month)

When a Tier Exception Makes Sense

You should consider a tier exception if:- You’re on a drug that’s not working well on a lower-tier alternative

- You had a bad reaction to a preferred drug - like severe nausea, rash, or dizziness

- Your current drug is the only one that controls your condition

- You’re taking a specialty drug (like for MS, cancer, or autoimmune diseases)

- You’re approaching the coverage gap (donut hole) and want to avoid higher coinsurance

- A patient on Xarelto for blood clots was paying $45/month on Tier 3. After a tier exception, they got moved to Tier 2 - paying $10/month.

- Another patient on Copaxone for multiple sclerosis dropped from $1,200/month (Tier 5) to $60/month (Tier 2) after submitting clinical notes showing previous drugs caused severe liver damage.

How to Request a Tier Exception - Step by Step

This isn’t something you do alone. You need your doctor on your side. Here’s how it works:- Check your copay. If it’s higher than expected, ask your pharmacist if your drug is on a high tier. They can tell you which tier it’s on.

- Talk to your doctor. Say: “I can’t afford this copay. Can we file a tier exception to move this drug to a lower tier?”

- Your doctor fills out the form. Most plans have a standard form. Some allow electronic submission through their portal. The form asks why the preferred drugs won’t work for you.

- Your doctor writes a clinical justification. This is the key. Don’t let them write vague stuff like “patient prefers this drug.” That gets denied. They need to say:

- “Patient developed gastrointestinal bleeding on Warfarin, requiring hospitalization.”

- “Patient has severe allergic reaction to all sulfa-based drugs, making this the only viable option.”

- “Previous attempts with Tier 1 and Tier 2 alternatives failed to control symptoms, resulting in two ER visits.”

Specificity wins. Evidence wins. Documentation wins.

- Submit the request. Your doctor’s office usually submits it. Some plans let you submit it online. Either way, make sure you get a confirmation number.

- Wait for a decision. Standard requests take up to 14 days. If your health is at risk (like if you’re about to stop a critical medication), ask for an expedited review - they must respond in 72 hours.

- If denied, appeal. Don’t give up. The Medicare Rights Center says 78% of denied requests are approved on appeal - if you add more clinical evidence.

What Gets Approved - And What Doesn’t

Approved exceptions almost always involve:- Chronic conditions: rheumatoid arthritis, lupus, MS, heart failure

- Drugs with serious side effects on alternatives

- Patients who’ve tried and failed lower-tier options

- Medications with unique dosing or delivery methods (like injectables or infusions)

- Specific clinical language

- Proof that alternatives failed

- Documentation of adverse reactions

- Doctor’s signature or contact info

Timing Matters - Do This Before You Fill the Script

Waiting until you’ve paid $150 for your first fill is a mistake. The best time to request a tier exception is before you fill the prescription. Why? Because:- If approved, you pay the lower copay from day one

- If denied, you still have time to ask your doctor for an alternative

- You avoid paying out-of-pocket money that you might not get back

What to Do If You’re Denied

Denials happen - even with good documentation. But you’re not out of options.- Request a redetermination. This is your first appeal. You have 60 days from the denial date.

- Add more evidence. Send lab results, hospital records, or specialist letters. Don’t just say “my doctor says so.” Show proof.

- Ask for a peer-to-peer review. Some plans let your doctor speak directly to the insurer’s medical director. This works - especially for complex cases.

- Call your State Health Insurance Assistance Program (SHIP). They offer free counseling. Find yours at shiptacenter.org.

What’s Changing in 2025 and Beyond

Starting in 2025, the Inflation Reduction Act will cap out-of-pocket drug costs at $2,000 per year for Medicare beneficiaries. That’s huge. But it doesn’t mean tier exceptions disappear. Why? Because:- The $2,000 cap kicks in after you’ve spent that much - so lowering your monthly copay still helps you get there faster

- Some plans still charge coinsurance (not copays) on specialty drugs - tier exceptions can turn 40% coinsurance into a flat $10 copay

- Non-Medicare plans (like employer coverage) still use tiering - and tier exceptions work the same way

Final Tips to Maximize Your Savings

- Always ask your pharmacist: “What tier is this drug on?”

- Keep a copy of every form and denial letter - you’ll need them if you appeal

- Don’t wait until you’re in the donut hole - act early

- If your doctor says “I don’t do exceptions,” find another doctor - or ask them to refer you to someone who does

- Use free help: Call 1-800-MEDICARE or visit your local SHIP office

Tier exceptions aren’t a loophole. They’re a rule built into the system - designed to protect people who need specific drugs. If you’re paying more than you should for a medication that works for you, you’re not alone. But you’re also not powerless.

What’s the difference between a tier exception and a formulary exception?

A tier exception is for a drug that’s already on your plan’s formulary but is on a higher, more expensive tier. You’re asking to move it to a lower tier. A formulary exception is for a drug that’s not on the formulary at all - you’re asking to get it covered at all. Tier exceptions are easier to get because the drug is already approved; you just need a lower price.

Can I request a tier exception for any medication?

Yes - as long as the drug is on your plan’s formulary. You can’t request a tier exception for a drug that’s completely excluded. But if it’s listed, even on Tier 5, you can ask to move it to Tier 1, 2, or 3. Most requests are for brand-name and specialty drugs that cost over $50 per month.

Does my doctor have to submit the request?

Yes. Only your prescribing doctor (or their authorized representative) can provide the clinical justification needed. You can submit the form, but without your doctor’s signature and medical reasoning, the request will be denied. Don’t try to do it yourself - your doctor’s input is what makes it work.

How long does a tier exception take to process?

Standard requests take up to 14 days. If your doctor says your health is at risk - like if you’re about to stop a life-sustaining drug - you can request an expedited review. In that case, the plan must respond within 72 hours. Always ask for expedited if you’re in a time-sensitive situation.

What if I’ve already paid for my medication?

If you paid out-of-pocket and then get approved, you can ask for a refund. Submit a copy of your receipt and the approval letter to your plan. Most plans will refund the difference between what you paid and what you should have paid under the lower tier. It’s not automatic - you have to ask.

Can I get a tier exception for a drug I’ve been taking for years?

Yes. Even if you’ve been on the same drug for 10 years, if your plan changed its formulary or moved your drug to a higher tier, you can still request an exception. Insurance plans update their formularies every year. Your drug might have been on Tier 1 last year and moved to Tier 3 this year. That’s when you act.

Philip Blankenship

February 17, 2026 AT 21:56Man, I wish I knew about this years ago. My dad was paying $300 a month for his MS med until his nurse practitioner mentioned tier exceptions. We filed one, and suddenly it dropped to $45. Like, free money. Seriously, if you're on any specialty drug, don't just accept the copay - fight for it. It's not rocket science, just paperwork and a stubborn doctor.

Also, shoutout to pharmacists. They're the unsung heroes who actually tell you what tier your drug is on. Most people just assume the price is fixed. Nope. It's negotiable.

Oliver Calvert

February 18, 2026 AT 05:32Just want to add - if your doctor says 'I don't do exceptions' find a new one. Seriously. This is basic patient advocacy. If your provider won't help you navigate the system they're part of, they're not doing their job. I've seen people lose access to life-saving meds because their doc was too lazy to fill out a form.

Pro tip: Bring a printed copy of the tier exception form to your appointment. Most offices don't even have it on file.

Jonathan Ruth

February 18, 2026 AT 07:01Sam Pearlman

February 18, 2026 AT 10:11Geoff Forbes

February 19, 2026 AT 07:38Kancharla Pavan

February 20, 2026 AT 00:47People act like this is some kind of heroic act - it's not. It's a broken system that forces elderly people to become legal advocates just to afford their insulin. You don't get to pat yourself on the back for doing the bare minimum. This shouldn't be a 'hack'. This should be a right.

And don't get me started on how drugmakers price gouge, then let insurers hide behind 'formulary management'. It's a racket. The fact that we're celebrating paperwork as 'empowerment' is the saddest thing about American healthcare.

My aunt died because she skipped doses to save money. She didn't know about tier exceptions. No one told her. That's on all of us.

Dennis Santarinala

February 20, 2026 AT 06:15This is one of those things that feels like magic when you find out about it - like discovering a secret level in a video game.

I helped my mom file one for her heart med last year. We got it approved in 9 days. She now pays $8 instead of $110. That’s a car payment saved. Honestly? I think every Medicare recipient should have a ‘medication review’ once a year - just like a dental checkup.

Also - if your doctor’s office doesn’t have a form ready? Demand it. They’re supposed to have it. It’s not optional. They get paid for submitting these.

And yes - even if you’ve been on the drug for 10 years. Formularies change. Always check.

Liam Earney

February 21, 2026 AT 10:24I just cried reading this. Not because I'm emotional - I'm not - but because I remember when my sister was on Humira and the copay jumped from $40 to $220 overnight. We spent three weeks begging, calling, emailing, and finally her rheumatologist wrote this insane letter with MRI results, bloodwork, and a note that said 'patient has developed subcutaneous nodules on all Tier 2 alternatives'.

They approved it.

She cried too.

And now? She's stable. No more ER visits. No more panic about the bill.

I just wish this wasn't so hard. It shouldn't take trauma to get the medicine you need.

Thank you for writing this. Someone needs to.

❤️

PRITAM BIJAPUR

February 22, 2026 AT 19:18